Chase Bank offers a wide variety of banking, lending, and investment products to its clients. It is the largest financial services company in the U.S., and that shows in its ability to provide products for a range of clients. Chase Bank is suited to a broad spectrum of clients, ranging from students to military veterans and from the average household to private banking relationships. Although its presence may not be robust in every state, customers can open and service accounts online or through its mobile apps. There are several choices when opening a checking account.

The accounts do have monthly service fees, but they can be waived when you meet minimum balance requirements or by completing qualifying activities. Premium checking accounts also earn interest and waive some banking fees. Chase Total Checking is the bank's most popular checking account. Though this account doesn't earn interest on balances, it does offer convenient access to your money through Chase's network of branches, Chase DepositFriendly?

If you're a parent with a Chase Total Checking account, you can also open a Chase First Checking account to help your kids start learning the basics of money management. Got a mailer from Chase that offered $600 to open a checking and savings account. Being that I already had a handful of Chase credit cards I figured why not make some free money. So, I opened the accounts online and proceeded to add an external account to transfer funds into the new Chase accounts. After ACH verification I setup a couple of transfers and a couple of days later I find that my online account was suspended for suspicious activity. Called the banking and credit card customer support and they couldn't view or unlock my account.

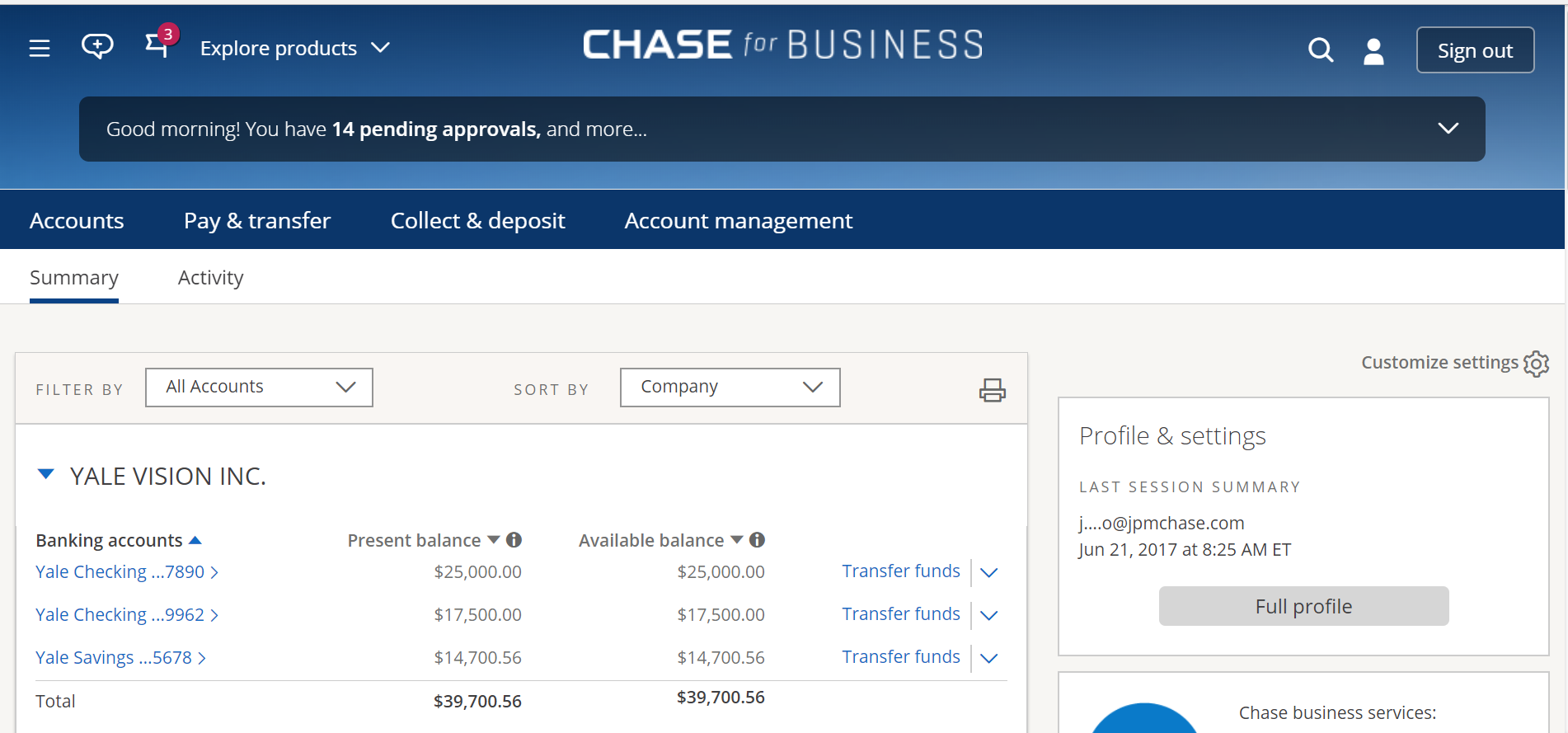

I was told to visit a branch in-person with two forms of ID to re-activate my account. As with the checking accounts, the higher-level savings accounts, which offers higher interest rates, has tighter requirements for avoiding the monthly service fee. This includes either a $15,000 minimum daily balance or having the account linked to a high-level checking account. As you might expect from a depository institution of its size, Chase Bank offers an extensive menu of accounts and services. Customers have access to multiple checking accounts, savings accounts, certificates of deposit , credit cards, and other lending products to meet their needs. The bank rewards customers who have multiple Chase products with better pricing and the ability to combine balances to waive fees.

Chase Bank, JPMorgan Chase & Co.'s consumer banking arm, is one of the nation's largest full-service banks. It offers a broad range of financial products and services to individuals and businesses. In addition to checking, savings and CD accounts, Chase is well known for its extensive credit card offerings, including popular travel rewards and cash back credit cards.

With options for adults, students and kids, Chase has accounts to fit most needs. Chase QuickPay is integrated with the Chase mobile app, which makes it a natural choice for P2P payments if you bank with Chase. You automatically get access when you use online banking with a Chase checking account or a Chase Liquid® Card, the bank's version of the prepaid debit card. Since it's designed to make transfers fast and simple, Chase QuickPay doesn't lose much utility in comparison to a standalone payment app like Venmo.

The Chase Total Checking® account offers a $225 bonus for new customers and a top-rated mobile app that makes banking easy. With both physical and online banking options, you can tailor your experience to your needs. Chase Total Checking ranks on our list of best checking account bonuses of 2021 because, in addition to the signing bonus, there is no minimum balance requirement to open a new account.

Once your application has been approved, you'll need to fund your account. If you're opening it at a physical branch, you can use a personal check linked to another checking account or cash. If you're processing the account online, you can link a debit card or checking account number to do a bank transfer, or you can use a non-Chase credit card to fund up to $500.

A debit will appear on your checking account and on your credit card statement online within 2 business days. Chase labels three of its checking accounts as "everyday" checking accounts. All three accounts offer access to nearly 16,000 ATMs and more than 4,700 branches nationwide.

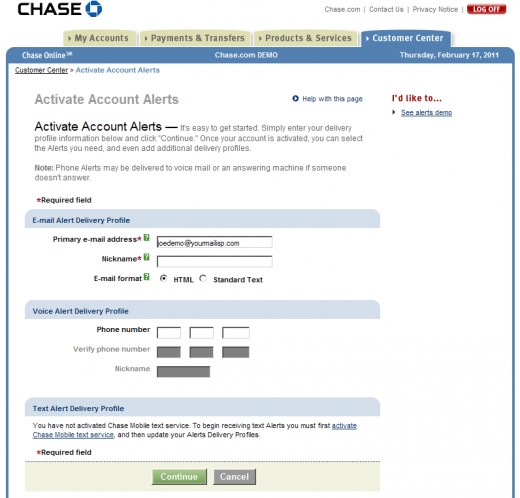

Each account offers online banking, online bill pay and mobile banking, as well as automatic transfers to Chase savings accounts. Chase Premier Plus Checking is an interest-bearing checking account. There is a monthly service fee but you can waive it by meeting minimum balance requirements or linking your account to an eligible Chase savings account. There's no fee for counter checks, money orders or cashier's checks, and you can get a small safety deposit box with no annual rent. As other mentioned, Chase has a serious problem with recent promotion offering $600 for new account opening.

I have been with Chase for over 20 years, using their credit cards and auto loan products. Last week I was offered $600 for opening a new account and I foolishly proceeded to open it. As with others here, I opened the account and set it up to be funded from my bank account that I've Been using for all those years to pay my Chase credit card and auto loan bills. But when I wanted to log in, my online account was locked, including all my credit cards and my new bank account.

No one could tell me anything except advising me that the only way to deal with that would be visiting Chase local branch. We only have ONE local branch in Boston Area and it is 35 miles from me. I have the Chase app which allows me to transfer money and pay bills for them as they don't do anything online. This was always fine as I personally did not have accounts with Chase.

Recently we refinanced our home through Chase and I opened an Amazon Prime credit card, which is also through Chase. Both of my new accounts appeared in the Chase app without my setting them up (along with my parents' accounts). I am having difficulty adding an external account to pay my mortgage. I added the account, but the only option to "Pay from" are my parent's accounts!

Speaking of technology, Chase's incorporates all of your accounts with the bank. When you pull up your mobile account, for instance, you can get instant access to your checking and savings account balances, as well as your outstanding credit card balance. You can make transfers between accounts, wire money to a friend or family member, or pay bills all from your mobile. The Chase Bank mobile app provides a consolidated view of your relationship with the bank. Benefits include facial recognition and fingerprint sign-in, reviewing account activity, and instantly blocking credit card transactions if you've misplaced your card. You can also send and receive money through Zelle, pay bills, and deposit checks.

Chase offers several tiers of checking and savings accounts. Each account grants its owner access to all of the bank's physical locations and ATMs as well as Chase's online banking and mobile app. You can also avoid paying the fee with a combined daily average of $5,000 across all your Chase accounts.

You can open anaccount onlinewith SDCCU in just a few easy steps. You can transfer funds from an existing SDCCU account, with your credit or debit card or from a checking or savings account at another financial institution. You'll just need your account number and the bank routing number of the bank account you are transferring from. You will need to maintain a minimum account balance in order to waive a fee. Similarly, the monthly fees under Chase's checking and savings accounts are waivable.

One of the better offerings from the banking giant is Chase College Checking. The account is designed for college students ages 17 to 24. There is no monthly service fee for college students for up to five years while you attend school, provided you show proof of your student status. The account comes with a free debit card and account access online and through Chase's mobile app.

Chase First Banking is available to children ages 6 or older whose parents have an eligible Chase checking account. This account comes with its own debit card that allows parents to place spending limits while teaching kids about money. There's no monthly service fee for this account, though other fees may apply.

Chase Bank represents the U.S. consumer and commercial banking business of JPMorgan Chase & Co. Its history dates to 1877, with the founding of Chase National Bank. It's one of the nation's largest "big banks," serving nearly half of American households with a range of banking products that includes checking accounts, savings accounts and credit cards. Both TD Bank and Chase offer savings accounts, checking accounts, CDs, IRAs and convenient mobile features, but they offer different interest rates. For savings accounts, TD Bank provides the TD Simple Savings and the TD Preferred Savings accounts.

The TD Simple Savings account functions as the bank's most basic savings account. It allows you to open the account with any deposit amount. Once you open the account you begin earning at a 0.05% APY. The Preferred Savings account, however, allows you to earn at a higher interest rate when you have a higher account balance. Having had two Chase credit cards, Freedom & Sapphire, which I enjoyed the online experience for many years, I was seduced by an offer from Chase to open a Checking & Savings account.

After opening the accounts, I attempted to transfer money into them by linking to my current bank & my Fidelity account. How can I fail if I know the UID and password for my account! The only thing that I did wrong was to fall for the scam effort to get me to open another account. If I wanted to go to a branch of a bank, I would pick a local one.

I have always been pretty poor and have yet to even get a credit card of any kind so I don't know how much my review will matter. I've only overdrawn my account a few times and they are always quick to reverse the charge for me due to my good standing. I've never had any problems logging into the site or having it display incorrectly from any computer or browser I have used.

Chase also offers additional niche checking accounts that cater to specific audiences. The Chase Secure Banking checking account has no minimum deposit, no paper checks, and does not charge for money orders or cashier's checks. Active and veteran members of the military can open a Chase Premier Plus Checking account with no fees or minimum balance requirements. Chase Bank provides a wide range of accounts and services, as one would expect from a depository institution of its size.

Customers can meet their financial needs by choosing from a variety of checking accounts, savings accounts, certificates of deposit , credit cards, and other lending products. Customers who have multiple Chase products benefit from better pricing and the ability to combine balances to avoid fees. Chase Bank offers a robust selection of checking accounts to meet varying banking needs. Like its savings accounts, most of Chase's checking accounts feature a monthly service fee. Chase generally offers ways to waive these fees, though.

Chase also offers a wide range of other financial products and services, including loans, credit cards and investments, as well as business and private client options. If you're looking for a one-stop-shop for all your financial needs, Chase is a good option to consider. You may be interested in opening a Chase Savings account if you want to earn interest with a low monthly maintenance fee. TD Bank and Chase are two large financial institutions that provide an extensive range of products both through online services and numerous branches. If you're looking to put your hard-earned paycheck into a savings account at TD Bank or Chase, it's important to first understand what the two banks offer and how they differ. Read on to learn more about how the accounts, fees and rates for each vary.

After reading all these negative reviews I felt I had to share my experience. I have been with Chase for 40 years since I opened my first checking account and have all my accounts, mortgage, credit cards with them. I was with them when online banking first came out and except for one small glitch 40 years ago when they first started online banking I have had no problems with them since then. I find the online banking system extremely helpful and got my brother to start using it now as he does not get out much. I am sure people have problems with them but without knowing all the circumstances of each situation its hard to know why. Popular credit cards with well-known brands – Chase offers a total of 30 credit cards from which to choose, 24 personal ones and six for small businesses.

There are a variety of credit card options, depending upon your goal of cash back, travel rewards, or balance transfer. You'll have until the end of the business day/cutoff time to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions. There's a three-per-day maximum for these fees (totaling $102), and they don't apply to withdrawals made at an ATM. Chase Private Client Checking℠ requires a $150,000 minimum daily balance in all your linked deposit and/or investment accounts to qualify for the waived service fee. If you have a linked business checking account, the fee may also be waived. Each checking account gives users access to mobile banking, including online bill pay, and comes with a debit card that has a security-enhancing chip.

As an example, Axos Rewards Checking is an online-only checking account that offers customers a 1.25% APY. However with Axos Bank, you won't have access to in-branch customer service, and the online bank generally does not offer checking bonus for new customers. Sapphire Banking is one of two premium checking account options offered by Chase. This account offers a variety of perks, including no ATM fees worldwide, fee waivers and higher limits on purchases, ATM withdrawals, Chase QuickDeposit and Chase QuickPay with Zelle. This account also earns interest, though you'll need at least a $75,000 minimum balance in eligible deposits/investments to avoid the $25 monthly fee. If you're enrolling in mobile and online banking to access your business accounts, you'll need an ATM or debit card.

You can apply for these at a branch and use your PIN to log in to mobile or online banking. Next, create a unique username and password to log in securely in the future. One advantage with TD Bank is that accounts typically don't require a minimum balance to open. Many accounts also have no monthly fees or allow you to waive fees if you maintain a certain account balance.

With the wide range of banking options, you can access your money either at physical locations or online. Some time ago Chase, with warning, discontinued the mobile app for Windows OS. For a few years since then I had access to conduct transactions using the full website. Every attempt to log onto my account opens a page of advertising for credit cards and other Chase products.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.