As early as eight years old, your child will be able to open a MONEY teen checking account at Capital One. While a savings account can help them accrue money, a checking account like this one will show them how to manage and spend it. They'll receive access to the Capital One mobile banking app and website, along with a free debit card. Your child may be eligible for a debit card or ATM card to spend or access the account if they open eligible bank accounts at a banking, fintech company or credit union.

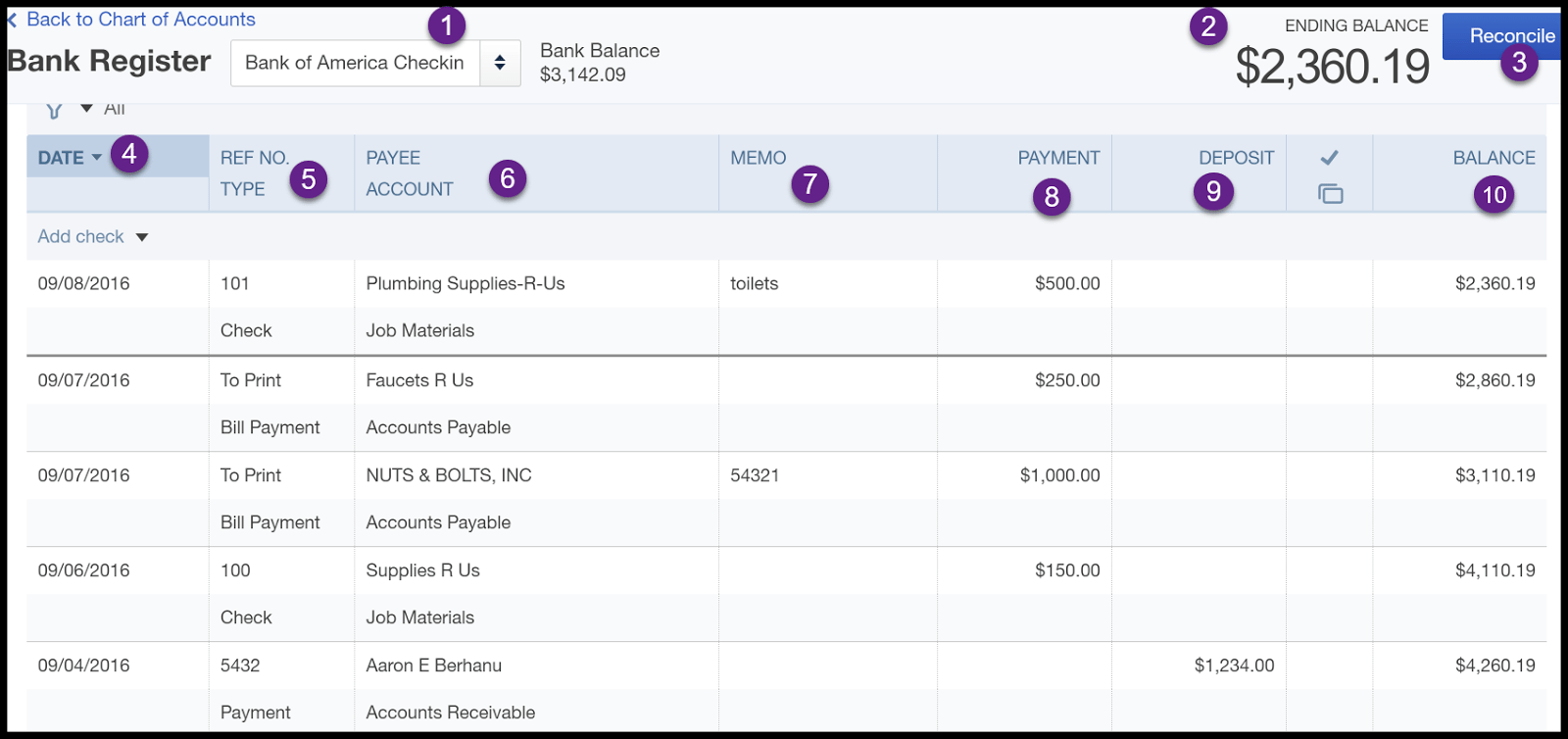

When your teen is learning about money management and banking, a checking account is a great first step. A checking account can help teach teens, with a parent's guidance, how bank accounts work, how to use online banking tools, and how to write a check. It can also help parents start discussions with their teens about the importance of creating budgets, managing spending, and saving money. With a checking account focused on 16- and 17-year-olds, First National Bank and Trust Company has no monthly fees and a $25 minimum balance to open.

To personalize the account for teens, the bank offers high school logo checks and debit cards with personalized photos for a small fee. Mobile banking, online access, and bill paying are included with the teen checking account. The Youth Spending account offered by USAA Federal Savings Bank does not charge maintenance fees and has no account minimums.

The checking account offers adult account co-owners a variety of options to limit spending, withdrawals, and transfers, as well as overdraft protection with linked credit cards or accounts. After turning 18, the account automatically converts to a free Classic Checking account which also has no monthly fees. The Teen Access Checking account at Union Bankshares is designed for teens between 13 and 17. It requires $100 to open and does not charge a monthly maintenance fee.

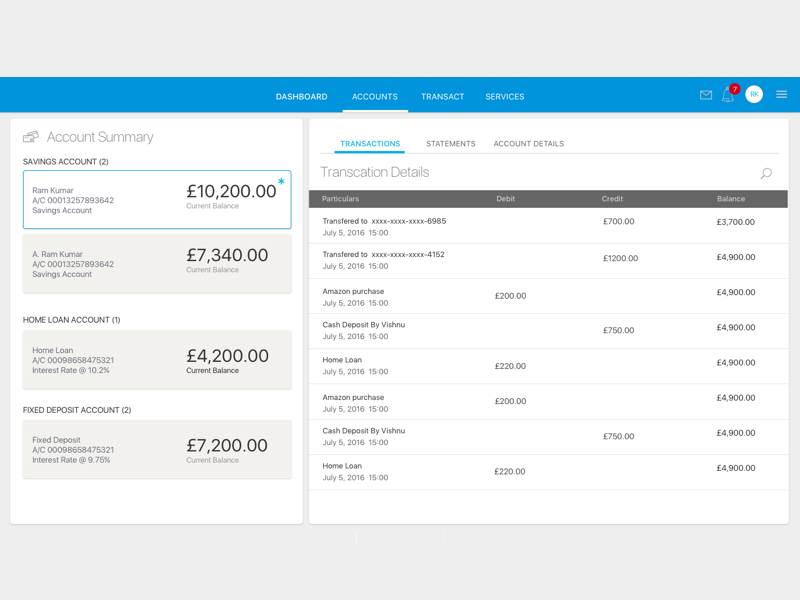

The key feature of the account is the ability for parents to set daily spending and withdrawal limits on the ATM or debit card that comes with the account. The account offers access through its mobile banking app, the online banking website, and through its bill-paying program. This youth checking account charges no monthly fees and has no minimum balance requirement once you open it with at least $25. Parents can sign up for account alerts, transfer money into the account and choose whether or not the child can transfer money and make deposits.

You also may request an ATM/debit card, which can be used at over 60,000 USAA-friendly ATMs. The account's adult co-owner also has the ability to limit or disable ATM and debit card usage by the minor. As your children grow, there's bound to be a shift in their spending and saving habits. It's essential to continue conversations about financial goals and responsible behavior as they graduate from simple savings accounts to prepaid cards and checking accounts. Both you and your child can have free, fast and secure access to view balances, make deposits and transfers, set up text alerts and more. The account comes with two free Visa debit cards — one for the teen and one for the adult.

You can use these debit cards at over 80,000 ATMs for free, although Alliant Credit Union will also provide up to $20 per month in ATM rebates. The account limits ATM cash withdrawals to a low $100 per day and debit card spending to $300 per day. Many parents will see these limits as appropriate, but responsible teens may feel differently, making it important to discuss anticipated spending levels before opening an account. The Alliant mobile app also comes with spending and budgeting tools to help any teen manage their account. It also works in the Capital One mobile banking app, where the teen and adult account owners each get their own login information.

The app allows teens to monitor their account and set savings goals. Parents can use the app to pay their teen's allowance, track the account and lock and unlock their kid's debit card. The account comes with a Capital One Mastercard debit card in the teen's name, which they can use to make free withdrawals at any Capital One or Allpoint ATM. The Teen Checking account at Wells Fargo & Company requires a $25 initial deposit and comes with no maintenance fees. For parents, notifications on transactions can be sent via text or email, and limits can be set on debit card spending and account withdrawals.

Teens can benefit from the money management tools available through the account. The bank offers mobile access for routine banking and fraud monitoring. Bank accounts aren't one-size-fits-all — pair that with a picky teen (we get it!), and it can be tough to figure out the best bank account for teenagers. These are just like 'adult' bank accounts, just without the overdraft facility or credit check.

So your child (aged 11+) can transfer money to other accounts and set up direct debits and standing orders. They also come with a debit card, or if you prefer, a more restricted cash card, which can only be used for cash withdrawals at ATMs. The best bank account for a teen is one that will help them learn to manage their finances and has low to no fees.

Mobile and online banking options can make personal finance management more accessible to teens, and caps on ATM withdrawals or spending limits are features to consider seeking out. Joint accounts are a great way to introduce young children to banking. A joint account grants full access to the adult and the minor. Consider the fee menu (monthly, recurring, transactions, ATM withdrawals, card reload, etc.). Savings accounts for kids make building a nest egg easy and accessible, but they typically come with a monthly service fee, monthly maintenance fee for having the account. In fact, some might come with other fees which make having the account cost prohibitive, like ATM withdrawal fees, card reload fees, annual card fees and more.

There are many fees businesses charge to open bank accounts. Sometimes they're not as obvious and you won't know how much is going to be charged until it's time to sign up for the account. Not sure that you're ready to open a checking account for your child? Getting a prepaid debit card that you load a certain amount of money onto each week or month could be a worthy alternative. With prepaid cards, teens still get the opportuntity to learn about money management -- but without the risk of overdrafting.These are our favorite prepaid cards for teens.

Justice Federal Credit Union's Young Savers Account is a children's savings account that only requires a $5 minimum deposit to open. While there are other kids accounts that feature better interest rates, you could do worse than Justice FCU's 0.15% APY. However, this rate only applies to balances of up to $19,999. Once you reach the $20,000 mark, your APY will increase to 0.20%. First Internet Bank calls its kids savings account "Tomorrow's Tycoons." The account comes with a 0.25% APY, which ranks in the upper echelon of savings rates for children's savings accounts. Account owners will not be charged a monthly fee with this account, though there is a $100 minimum opening deposit requirement.

Like any savings account, you can only withdraw money from this account up to six times per month. The Chase teen account itself is simple, requiring no minimum balances nor charging a monthly fee. It comes with a debit card, which is limited to $400 in purchases, $500 in Chase in-branch ATM withdrawals, $500 in other Chase ATM withdrawals and $400 in non-Chase ATM withdrawals per day. The Chase Mobile app enables mobile banking, as well as alerts for transfers, transactions, purchases and more.

The teen checking account at Alliant Credit Union offers online and mobile access, as well as limits on spending and withdrawals. The key feature is its APY of 0.25% which is available for accounts with paperless statements and at least one direct deposit per month. Alliant refunds up to $20 per month in ATM fees if the teen uses out-of-network machines. Because kids control most of their information through their phones, having a service provider who can provide online banking and management capability is imperative. If you have kids under the age of 18 then a card could be a great alternative to cash to teach them how to spend wisely.

There are two main alternatives – prepaid cards or debit cards that come with children's bank accounts. This guide takes you through the advantages and disadvantages of each to help you choose. Axos First Checking is one of the best starter checking accounts for kids for multiple reasons. First, it is set up as a joint checking account so that parents have equal access and control.

And account holders receive up to $12.00 in domestic ATM fee reimbursements per month. Garden Savings Federal Credit Union's Kids Club Savings Account is a basic children's savings option that features a strong interest rate on all balances. In fact, with just a $5 minimum, your child will receive a 0.50% APY.

Although some of the other accounts on this list feature higher rates, they are often capped at a maximum balance amount, which can limit earnings. This credit union does not charge any monthly fees in conjunction with this account. Parents, grandparents or legal guardians can connect their Alliant account with a Kids Savings Account. This will give you access to the child's current account balance, as well as mobile check deposit. The bank also has a few financial education programs available so kids can become more self-sufficient with their money management. This is why many banks offer parents to set withdrawal and debit card transaction limits.

Some even send text alerts to parents about their teen's banking activity. Another way to keep control over your teen's spending habits—especially if there are no parental control options available—is to become a joint account holder. Children ages are welcome to apply for a Parental Guarantee Joint checking account with their parent or guardian. They'll learn the responsibility of using a debit card to access their funds and, as a joint owner, you'll be able to see how the account is being managed. Checking and savings account.Make sure you can segregate your child's funds in a kids savings account and a separate checking account. Likewise, you can use many of the popular banking apps for minors to create savings pods that designate money held in the joint account for specific savings goals.

All the prepaid cards we've listed also allow contactless payments. ‡To be eligible for a free SPC membership, you must hold an eligible CIBC product at the time you register for the membership, which you must do through CIBC online or mobile banking. Eligible CIBC products include a CIBC Youth or Student bank account, Student credit card or Student line of credit. A complete list of eligible CIBC products can be found atSPC and CIBC.

Joint account holders of eligible CIBC products are not eligible for membership. The membership will automatically renew and remain in effect for as long as you hold an eligible CIBC product. BECU checking accounts are not age restrictive, so you can help your teen open a checking account at any age. As a reminder, a parent or guardian must be a joint account holder until the teenager turns 18. Among the most common ways to get minors banking is to open either a joint account or a custodial account.

Almost any bank or credit union will offer these kinds of accounts, so you'll just need to shop for the features that are most important to you. Look for low fees, a competitive interest rate, and an institution that's easy to work with. If you can't find anything locally, online banks are a good option. An Asterisk-Free Checkingaccount requires no minimum balance to open and no monthly maintenance fee. The benefits extend beyond just checking; there's no fee or minimum balance when you open and link a savings account to your Asterisk-Free Checking account. All Day Deposit℠, 24-Hour Grace® Overdraft Fee Relief, and the Huntington Mobile app, make it an affordable and convenient choice for a student bank account.

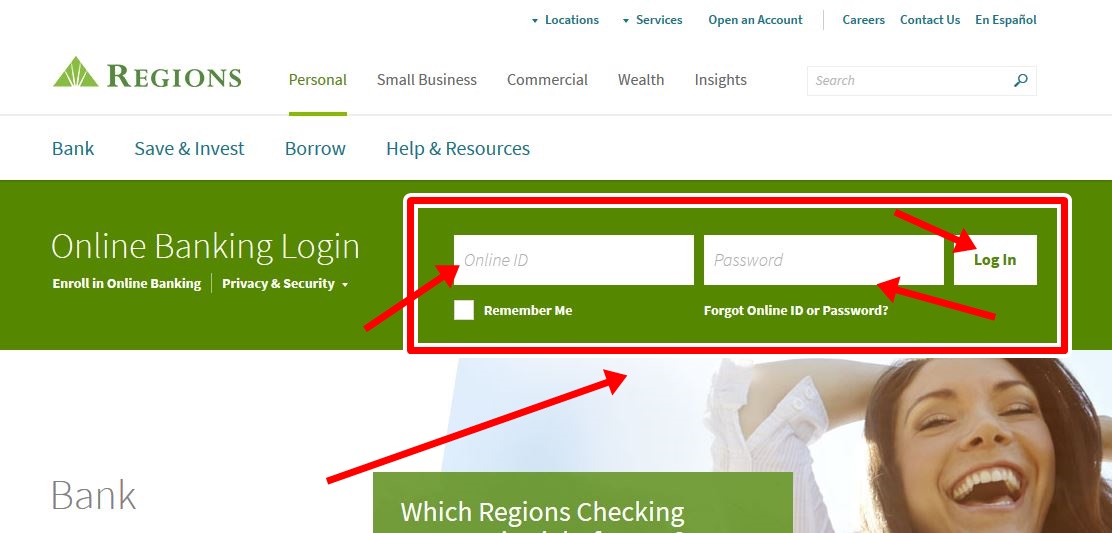

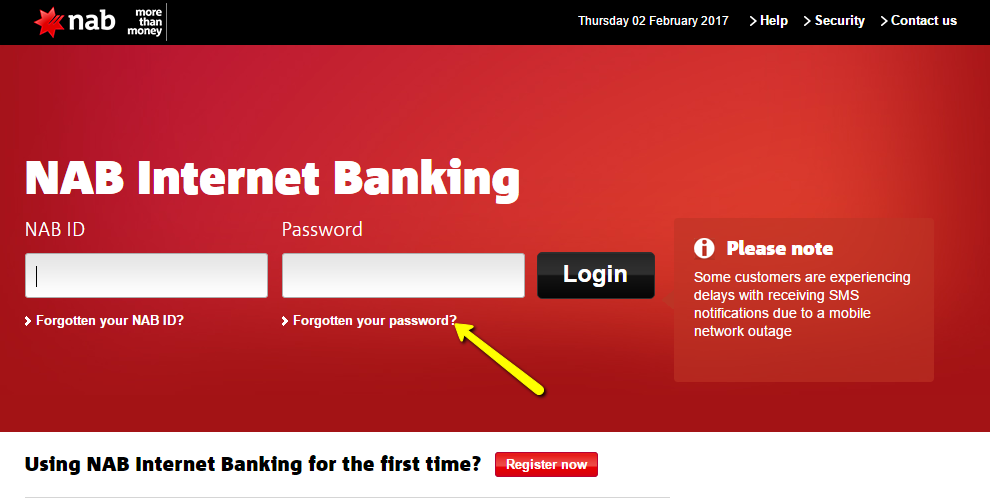

Both the teen and adult co-owner will need to open a teen checking account together. Depending on the bank, you may need to visit a branch to open a teen bank account, but there are several accounts that you can open online — in fact, some accounts are available only online. Additionally, some banks may require the adult owner to have a personal bank account with the bank. Opening a student account at Citizen's Bank, which is a subsidiary of Citizen's Financial , comes with no monthly fees until the age of 25. It also provides an account experience similar to joint checking accounts with online access and mobile banking. Get convenient account access, now with fingerprint sign-in and Touch ID®.

Use our free mobile app to deposit checks, check balances, pay bills, transfer money and locate ATMs and financial centers on the go. Plus, with our customizable mobile app alerts you can stay informed of just about everything that happens with your savings account. Our bank accounts for children are designed to grow with them. As they become teenagers and begin to get their first jobs, our account will allow them to have an account for saving and spending money, complete with a debit card and ATM access.

Copper is a banking app that helps teach teens about financial literacy. With parental oversight, Copper lets teens spend via an included Mastercard debit card. And parents are able to track and monitor their teens' spending.

By opening a joint checking account with your child, you can allow them to save and spend money while you monitor their spending habits. In this way, you can both work together to build his or her financial IQ. In this article, we'll go over three of the best starter checking accounts for kids available today.

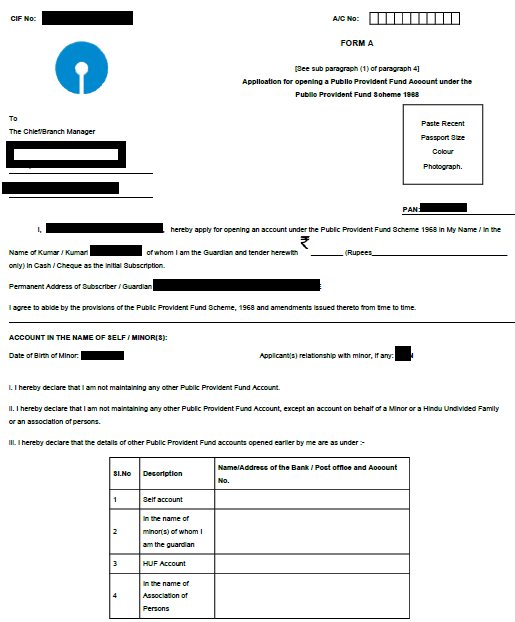

The Boeing Employees Credit Union Early Saver Account isn't a stand-alone offering. It's paired with a free checking account that both kids and their parents can use, giving this credit union a complete set of kids and teen banking accounts. Because of this, children are likely to get a very full experience of what it's like to manage finances, both on a long- and short-term scale. My First YES Account is the first step towards financial literacy for your child. This bank account gives your child the platform to learn the basics of banking and parents an avenue to save for their child's future in the form of Fixed Deposits and Recurring Deposits.

The Debit Card with variable limits allows teenagers to an easy access to their pocket money. It's never too early to start saving money, and banks keep your money safe. Plus, paying with a debit card makes life easy—you can't really shop online without one . For many, one of life's biggest frustrations is how little we learn about money management in our youth. Even better, parents can often aid in the learning process by setting account parameters and keeping an eye on their teen's spending. A teenager's first checking account should include features that help establish good financial habits to take into adulthood.

We looked at fees and service options on dozens of teen checking accounts to determine which ones make the most sense for teens in a variety of scenarios. The bank requires an adult to link an account to the teen's checking account. The fee monthly service fee is waived for up to five years while in college or if there is at least one direct deposit into the account every month. With no monthly maintenance fees or balance requirements, it's an ideal first checking account for teens with part-time or summer jobs.

All accounts come with a free Visa® debit card and a free first box of checks with both account holders' names. Start by choosing an account that has the features you need. The best bank account for teens will generally give you the features listed in the section above. Look out for ones that come with a debit card, internet banking, and ideally a branch near your home.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.